A detailed discussion of the principles of IFRS 13 Fair Value Measurement

-

Presenter: Anton van Wyk CA(SA)

-

Level: Intermediate

-

Study time: 2 hours, 30 minutes

Write your awesome label here.

Course overview

How fair is fair value really?

The International Accounting Standards Board (IASB) centralised the guidance around the determination and selection of fair value for purposes of financial reporting in IFRS 13 Fair Value Measurement. The IASB consequentially removed all other guidance relating to fair value determination from individual reporting standards and cross-referenced such standards to IFRS 13 instead. It is therefore very important that the guidance provided in IFRS 13 is well understood and correctly applied in a financial reporting context. In this on-demand short course, please join Anton van Wyk CA(SA) as we explore the most important principles underlying the determination and selection of an appropriate fair value to satisfy the requirements of this highly informative financial accounting standard.

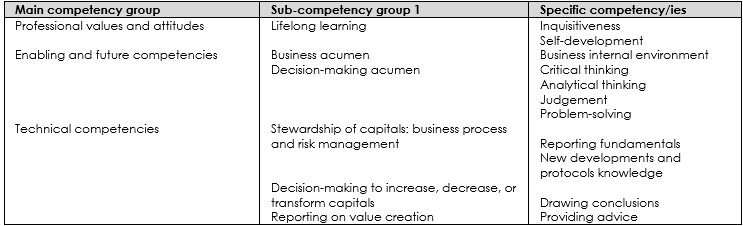

In completing this course, you will have developed the professional competencies listed in the green section below.

The accounting professional should, by now, be well aware of the prevalence and increase in importance of the concept of fair value accounting in the financial reporting sphere. There is an increased interest among users of financial statements in the fair values of assets and liabilities, rather than their historic carrying amounts. The question is: how reliable is the fair value of assets and liabilities in financial statements when its determination is subject to a high level of possible subjectivity? Individual financial reporting standards formerly defined “fair values” in various contexts, e.g., property, plant, and equipment, investment properties, financial instruments, etc.

The International Accounting Standards Board (IASB) centralised the guidance around the determination and selection of fair value for purposes of financial reporting in IFRS 13 Fair Value Measurement. The IASB consequentially removed all other guidance relating to fair value determination from individual reporting standards and cross-referenced such standards to IFRS 13 instead. It is therefore very important that the guidance provided in IFRS 13 is well understood and correctly applied in a financial reporting context. In this on-demand short course, please join Anton van Wyk CA(SA) as we explore the most important principles underlying the determination and selection of an appropriate fair value to satisfy the requirements of this highly informative financial accounting standard.

In completing this course, you will have developed the professional competencies listed in the green section below.

What's included?

- 1 Explanatory video

- 1 Slide deck

- 1 Quiz

- 1 Certificate of completion

Alignment to the SAICA Competency Framework