Accounting for business combinations – Consolidated in a nutshell!

-

Presenters: Anton van Wyk CA(SA) and Karen van Wyk CA(SA)

-

Level: Advanced

-

Study time: 1 Hour

Write your awesome label here.

Course overview

In this webinar, please join Anton van Wyk CA(SA) and Karen van Wyk CA(SA) delving into a deeper understanding of accounting for business combinations according to principles of international financial reporting standards. When doing so, the preparer of financial statements should bear solid knowledge of the following key areas:

- What is a business combination transaction? (e.g., acquiring a controlling equity stake in an entity versus directly acquiring the assets and liabilities of an entity).

- Again, a key understanding of what “control” constitutes, is essential, per the webinar “What is control?”.

- The main steps of accounting for a business combination transaction according to the only allowable method, being the “purchase method”, consisting of:

- Identifying who the acquirer is;

- Identifying the cost of the business combination transaction; and

- Appropriately allocating the cost of the business combination to identified assets and liabilities, including intangible assets.

- Key knowledge about understanding the treatment of intangible assets, and contingent liabilities at the acquisition date in a business combination transaction.

- An overview of the tax consequences (actual tax versus “accounting tax” (including deferred tax)) of business combination transactions.

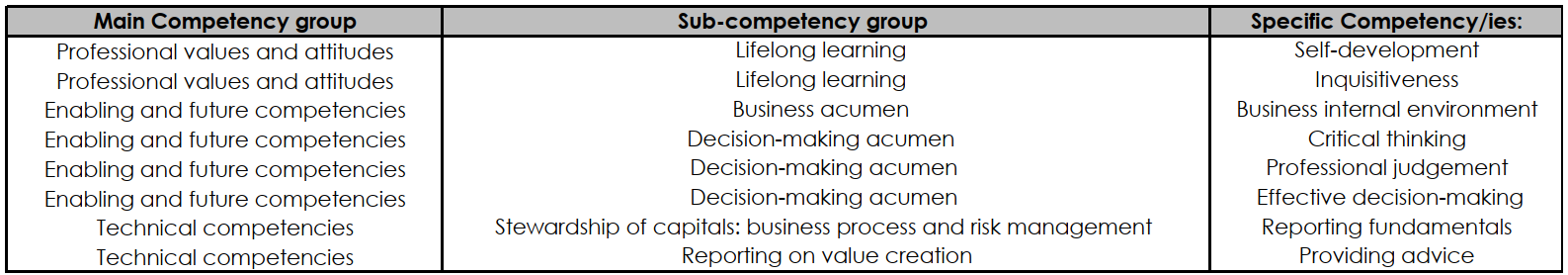

In completing this learning engagement, you will have developed the professional competencies in the green section below.

Link with SAICA Competency Framework