Asset Advantage: Maximising Tax Allowances

-

Presenters: Karen van Wyk CA(SA)

-

Level: Advanced

-

Study time: 1 Hour

-

Date: 20 February 2025

08:00 - 09:00

Write your awesome label here.

Course overview

We are

excited to continue with the highly popular "Back to Brilliance" tax

series, which was launched in 2024, and continue to build on the valuable

insights shared in previous sessions.

In

this one-hour webinar, we will explore how taxpayers can leverage tax

allowances to their advantage, ensuring they maximise potential savings and

reduce their tax liabilities. Understanding the full scope of claimable tax

allowances is essential for optimising financial outcomes, whether for

businesses or individual taxpayers.

Throughout

the session, we will delve into key tax allowances, highlighting how to claim

these correctly and strategically. By the end of the webinar, attendees will be

equipped with practical knowledge on how to enhance their tax strategy,

ensuring they reap the full benefits available under tax law.

We

will also cover the important links between tax allowances and other areas of

taxation. This includes the impact on the tax value of the asset, the influence

on your capital gains tax position, etc. Understanding these connections is

crucial for crafting a comprehensive tax strategy that not only maximises

current savings but also ensures long-term financial efficiency.

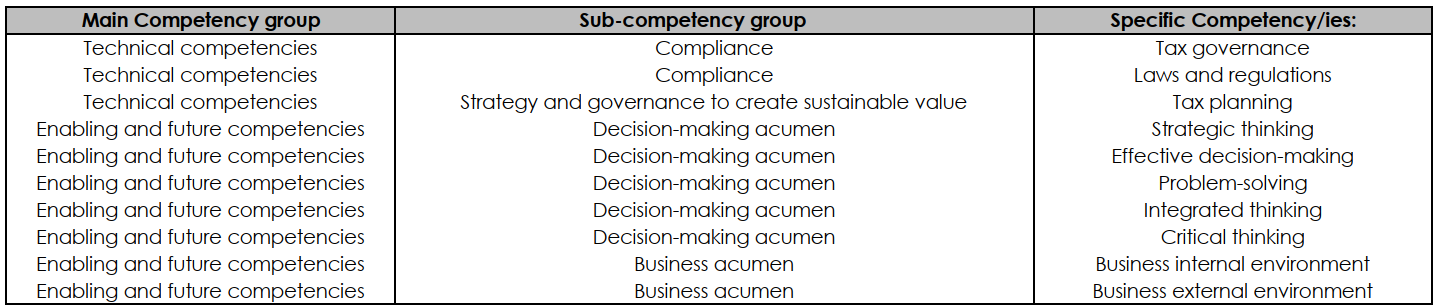

In completing this learning engagement, you will have developed the following professional skills in the green section below.

In completing this learning engagement, you will have developed the following professional skills in the green section below.

What's included?

-

1 Live event

-

1 Quiz

-

1 Certificate