Back to Brilliance Tax Series: Being brilliant at navigating the essentials of provisional tax

-

Presenter: Karen van Wyk CA(SA)

-

Level: Advanced

-

Study time: 1 hour

-

Date: 15 February 2024

08:00 - 09:00

As part of our ongoing "Back to Brilliance Tax Series," we invite you to join our latest webinar focused on mastering the essentials of Provisional Tax. Whether you're a business owner, self-employed professional, or simply looking to enhance your understanding of tax obligations, this webinar is tailored to equip you with the knowledge and strategies needed to navigate the complexities of provisional tax successfully.

Who Should Attend:

• Business owners and entrepreneurs.

• Self-employed professionals.

• Tax practitioners and consultants.

• Individuals interested in optimising their tax position.

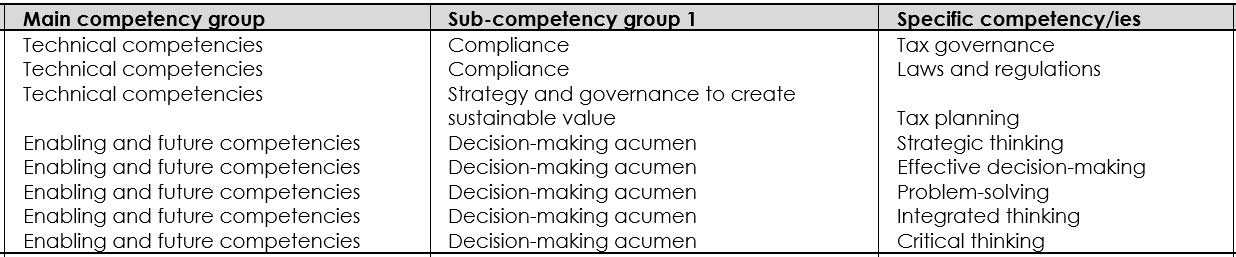

Don't miss this opportunity to enhance your knowledge and skills in navigating the essentials of provisional tax. Register now to ensure you're well-prepared to meet your tax obligations efficiently and strategically. Let's turn the complexities into brilliance at our upcoming webinar! In completing this learning engagement, you will be developing the following professional competencies

in the green section below.

What's included?

-

1 Live event

-

1 Quiz

-

1 Certificate