Back to Brilliance Tax Series: Profit for purpose – being brilliant at donations and dividends tax

-

Presenter: Karen van Wyk CA(SA)

-

Level: Advanced

-

Study time: 1 hour

-

Date: 10 October 2024

08:00 - 09:00

Reignite your tax brilliance with our specialised webinar, "Back to Brilliance Tax Series: Profit for Purpose – Being Brilliant at Donations and Dividends Tax." In this unique session, the next instalment of this tax-focused series, we dive into the tax consequences of profit for purpose, be it dividends or donations, and exploring how tax strategies align with such. This instalment of our tax series emphasises the impact of donations and dividends tax on businesses. Join us as we chart a course through understanding the tax consequences of the assignment of profit to different stakeholders.

Who Should Attend:

• Tax professionals, CFOs, and financial strategists.

• Business leaders committed to sound application of tax principles.

• Anyone interested in aligning tax strategies with purpose-driven business goals.

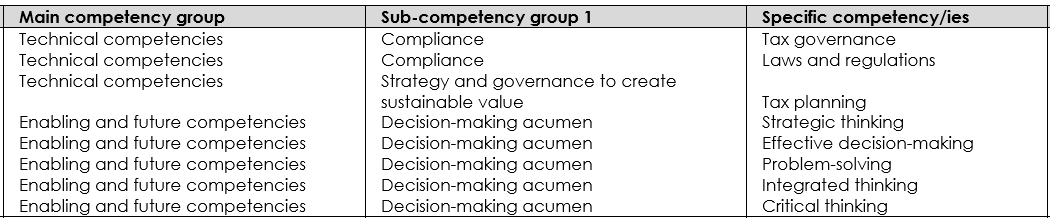

Don't miss this opportunity to explore the tax consequences of decisions made regarding a business’ profit. Register now to gain unique insights, discover brilliance in donations and dividends tax, and position your business and/or clients to be informed about the tax consequences of related decisions made. When completing this learning engagement, you will be developing the following professional competencies in the green section below.

What's included?

-

1 Live event

-

1 Quiz

-

1 Certificate