Back to Brilliance Tax Series: Small business – big impact! Brilliance at small business tax planning

-

Presenter: Karen van Wyk CA(SA)

-

Level: Advanced

-

Study time: 1 hour

-

Date: 4 April 2024

08:00 - 09:00

Embark on a journey to maximise the impact of your small business through strategic tax planning in our latest instalment of the "Back to Brilliance Tax Series." Join our webinar, "Small Business, Big Impact! Brilliance at Small Business Tax Planning," designed to empower entrepreneurs, small business owners, and aspiring business leaders with the knowledge and strategies to navigate the intricacies of tax planning effectively.

Who Should Attend:

• Small business owners and entrepreneurs.

• Start-up founders.

• Financial and accounting professionals serving small businesses.

• Anyone interested in optimising tax strategies for small business success.

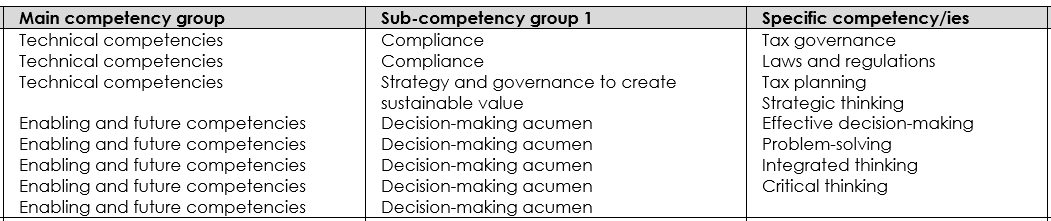

Don't miss this opportunity to empower your small business with brilliance in tax planning. Register now to gain valuable insights, practical tips, and strategies to navigate the tax landscape effectively. Let's make small business tax planning a catalyst for brilliance! In completing this learning engagement, you will be developing the following professional competencies in the green section below.

What's included?

-

1 Live event

-

1 Quiz

-

1 Certificate