Back to the future – A conversation about deferred taxation

-

Presenters: Anton van Wyk CA(SA) and Karen van Wyk CA(SA)

-

Level: Advanced

-

Study time: 1 Hour

Write your awesome label here.

Course overview

In this session, we delve into the principles underlying the topic of deferred

taxation. In one hour, revisit the most important concepts contained in IAS 12 Income

Taxes and firstly gain an understanding of why deferred tax should

be calculated – is a deferred tax liability even an actual liability, if it

relates to the realisation of future economic benefit inflows and outflows?

Secondly understand the method that is used to calculate deferred tax,

being an “asset and liability focused method”, focusing on the future economic

benefit inflows and outflows represented by the realisation of these elements.

Also get guided through some practical application and examples on the topic.

It is important to note that the IFRS for SMEs has been fully aligned with IAS

12 Income Taxes, and deferred tax principles should be consistently

applied in full IFRS as well as the IFRS for SMEs. The partial recognition

method is also no longer applicable.

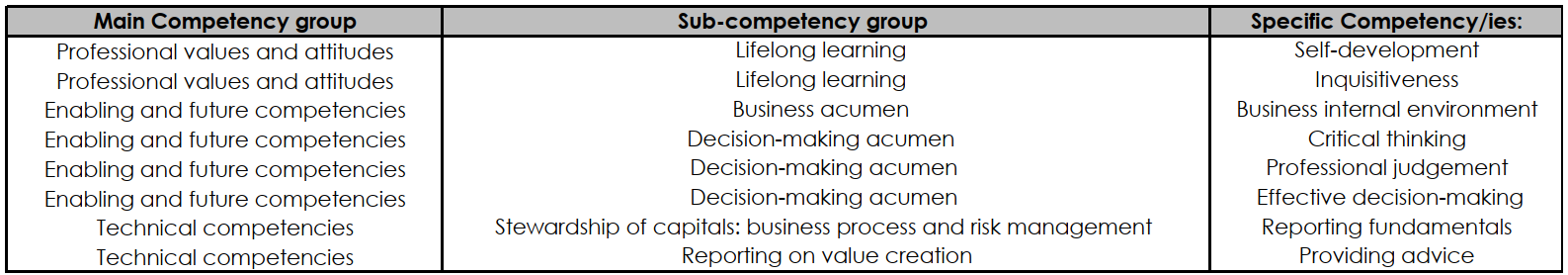

In completing this learning engagement, you will have developed the professional competencies in the green section below.

In completing this learning engagement, you will have developed the professional competencies in the green section below.

Link with SAICA Competency Framework