Demystifying the intricacies of Section 20 Leases of the IFRS for SMEs

-

Presenters: Anton van Wyk CA(SA) and Karen van Wyk CA(SA)

-

Level: Advanced

-

Study time: 1 Hour

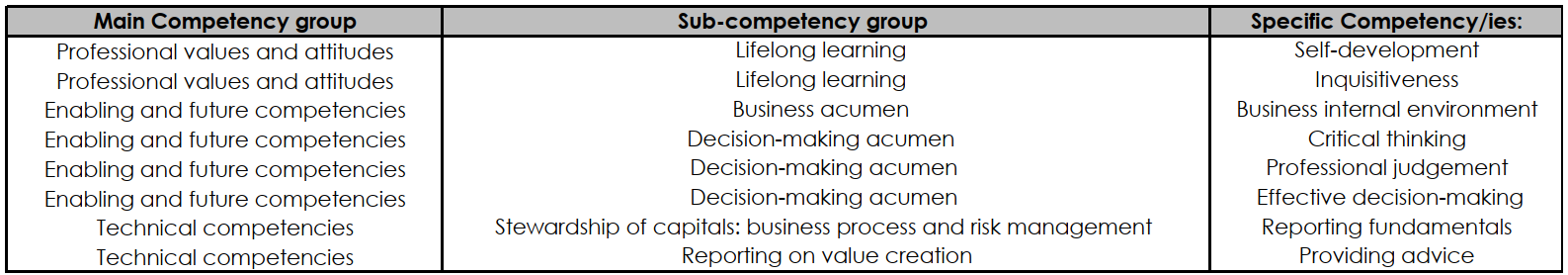

This webinar explains the important principles when applying lease accounting from Section 20 of the IFRS for SMEs. The IASB has not included Section 20 for alignment with full IFRS 16 in the planned amendments to the IFRS for SMEs in 2025 – this may be done at a later stage. It is therefore still very important that preparers of financial statements understand the key differences between accounting for operating leases versus finance leases. The capitalisation of leased assets in finance leases, regardless of whether or not legal title transfers from the lessor to the lessee at any stage during the lease agreement, must remain one of the most noteworthy applications in financial reporting of the concept of “economic substance” being accounted for above the mere “legal form” of a transaction. Join Anton van Wyk CA(SA) and Karen van Wyk CA(SA) in learning and refreshing the principles of lease accounting. This learning engagement also contains a very helpful supporting module containing detailed examples of the application of lease accounting per the requirements of Section 20. In completing this learning engagement, you will have developed the professional competencies in the green section below.

Link with SAICA Competency Framework