Digital taxes unlocked: Navigating cryptocurrency and digital transactions

-

Presenters: Thomas Lobban

-

Level: Advanced

-

Study time: 2 Hours

-

Date: 13 February 2025

08:00 - 10:00

The rise of cryptocurrency and other digital

platforms has revolutionised the way transactions are conducted — but it has

also introduced potentially complex tax implications that professionals can no

longer ignore. As governments around the world work to catch up with this rapid

digital transformation, understanding the tax consequences of digital

transactions has become a critical skill. This webinar dives into the tax

treatment of cryptocurrency and other digitally effected transactions. We’ll

explore key topics, including the taxability of crypto gains, compliance

obligations, and how digital platforms are reshaping traditional tax concepts.

Whether you're advising clients or managing your own tax affairs, this session

will provide clarity on the challenges and opportunities presented by the

digital economy. Join us to stay ahead of the curve and ensure you’re prepared

to navigate the evolving world of digital tax with confidence!

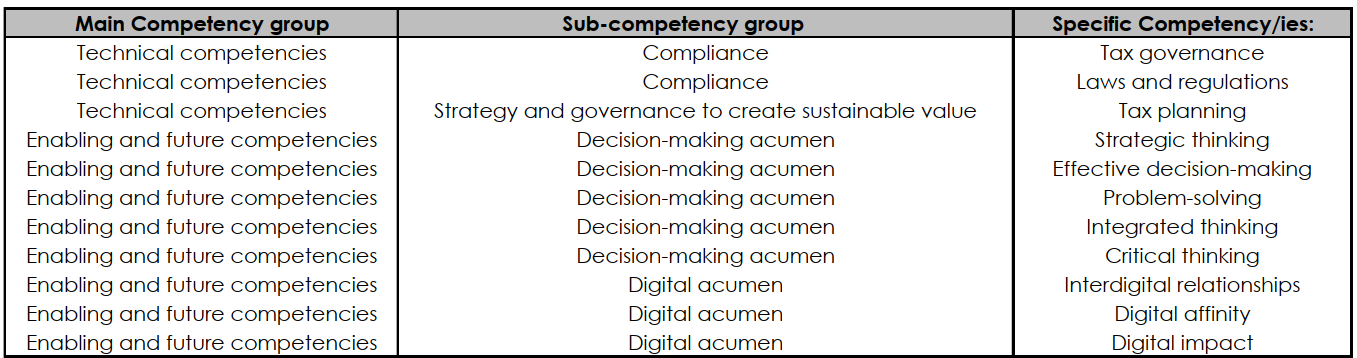

In

completing this learning engagement, you will have developed the following

professional skills in the green section below.

What's included?

-

1 Live event

-

1 Quiz

-

1 Certificate