From Shelf to Statement: Taxing Trading Stock

-

Presenters: Karen van Wyk CA(SA)

-

Level: Advanced

-

Study time: 1 Hour

-

Date: 12 June 2025

08:00 - 09:00

In this insightful one-hour webinar, we will explore the tax consequences associated with trading stock, offering a comprehensive overview of how VAT, Income Tax, and other taxes apply to the movement and disposal of stock. The session will cover critical scenarios such as the purchase and sale of stock, writing off unsellable items, donating stock to charitable causes, and declaring stock as a dividend in specie.

Participants will gain a thorough understanding of the tax implications tied to each of these actions, helping businesses and individuals navigate the complexities of trading stock and ensuring compliance with tax regulations. We will explore how these transactions impact the bottom line, enabling effective decision-making and ensuring that businesses make informed choices.

This

session is part of the "Back to Brilliance" tax series, continuing

the exploration of key tax topics introduced in 2024. Join us to deepen your

knowledge of trading stock and refine your tax strategy in this essential area

of taxation.

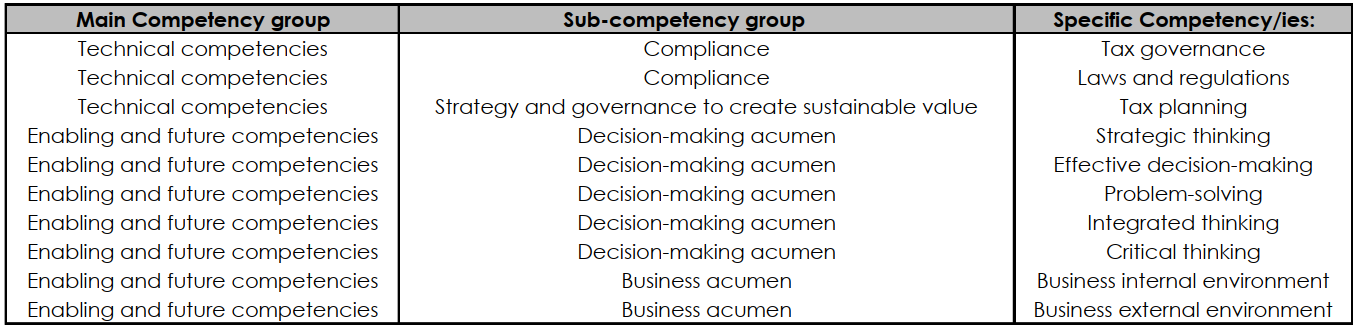

In

completing this learning engagement, you will have developed the following

professional skills in the green section below.

What's included?

-

1 Live event

-

1 Quiz

-

1 Certificate