Getting to grips with Section 34 of the IFRS for SMEs – reporting “Agriculture” in the financial statements

-

Presenters: Anton van Wyk CA(SA) and Karen van Wyk CA(SA)

-

Level: Advanced

-

Study time: 1 Hour

Write your awesome label here.

Course overview

In this interesting webinar about a topic that is not often considered, Anton van Wyk CA(SA) and Karen van Wyk CA(SA) delve into the financial reporting principles underlying agriculture. The scope of Section 34 is considered together with some important explanatory definitions. A discussion is held about the important accounting policy choice relating to agricultural activities, after which the principles of recognition of such are explained. Measurement of agriculture related transactions is very interesting, as the fair value model (i.e., recognised through profit or loss) or the (historic) cost model could apply, in different circumstances – the webinar also investigates these measurement models. Consideration is finally given to accounting for products resulting from the processing of agricultural produce, and some concluding examples tie all the principles nicely together.

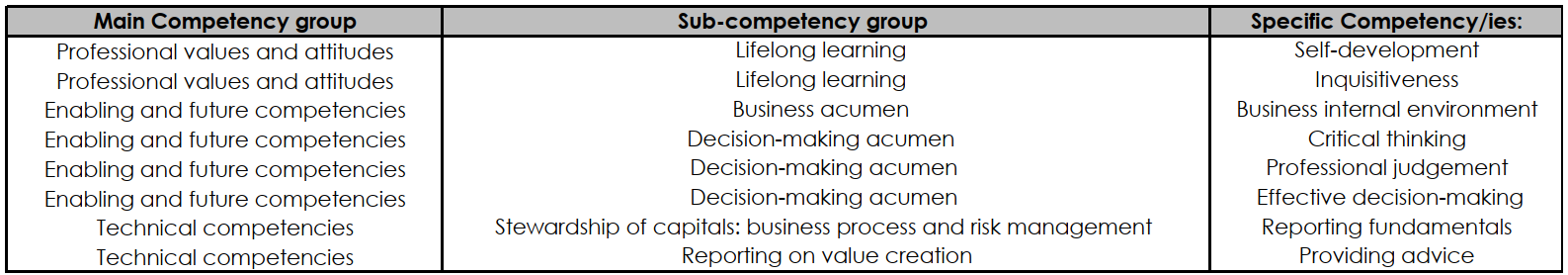

In completing this learning engagement, you will have developed the professional competencies in the green section below.

Link with SAICA Competency Framework