Mapping the path to understanding tax residency issues

-

Presenter: Dirk Kotze CA(SA)

-

Level: Advanced

-

Study time: 1 hour

-

Date: 26 September 2024

08:00 - 09:00

In today's globalised landscape, understanding tax residency is paramount for individuals and businesses alike, ensuring compliance and enabling effective tax planning strategies. In this webinar you will gain a thorough comprehension of tax residency, including its legal framework, determining factors, and implications for taxation. From expatriates to multinational corporations, understand how residency issues arise and strategies for addressing them effectively. Ensure you seize this chance to arm yourself with the essential knowledge and strategies required to effectively navigate tax residency issues.

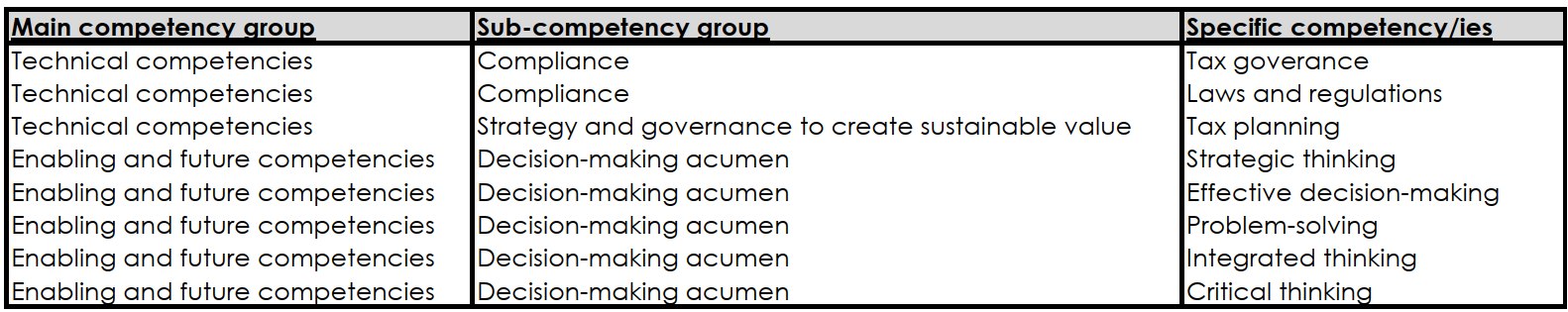

In completing this learning engagement, you will be developing the following professional competencies in the green section below.

What's included?

-

1 Live event

-

1 Quiz

-

1 Certificate