Revenue recognition in a five-step model – Heading to an SME near you, soon!

-

Presenters: Anton van Wyk CA(SA) and Karen van Wyk CA(SA)

-

Level: Advanced

-

Study time: 1 Hour

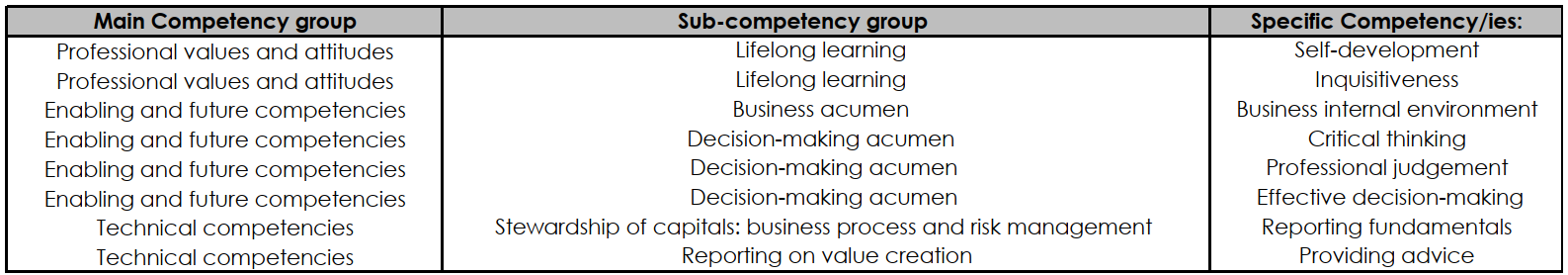

In this webinar, Anton van Wyk CA(SA) and Karen van Wyk CA(SA) cover the five-step revenue recognition model introduced by IFRS 15 Revenue from Contracts with Customers. This model is expected to be included in the amendments to the IFRS for SMEs (expected for release in the first quarter of 2025), meaning that SMEs will in future be required to adopt the five-step model in their revenue recognition policies and procedures. The webinar also includes a discussion of contract costs, which is a new section introduced by IFRS 15, and in conclusion contrasts the revenue recognition principles of IFRS 15 to the current IAS 18 Revenue Recognition, so that you can easily identify the differences that will become relevant in the near future, especially when the revenue recognition model is adopted into the IFRS for SMEs. The current IFRS for SMEs follows IAS 18 and is expected to adopt the approach illustrated by IFRS 15. In completing this learning engagement, you will have developed the professional competencies in the green section below.

Link with SAICA Competency Framework