The 2024/5 Tax Update (Tax Laws Amendments Act)

-

Presenter: Jackie Arendse CA(SA)

-

Level: Advanced

-

Study time: 2 hours

-

Date: 14 November 2024

08:00 - 10:00

Stay ahead of the fiscal curve with the webinar, "The 2024/5 Tax Update: Navigating Changes with the Tax Laws Amendments Act." Tailored for tax professionals, financial experts, and businesses, this session provides a deep dive into the latest tax landscape shaped by the Tax Laws Amendments Act. Join us as we explore the key amendments, regulatory updates, and strategic considerations that will define tax planning and compliance in the upcoming fiscal year.

Who Should Attend:

• Tax professionals, accountants, and financial advisors.

• Business owners, CFOs, and tax managers.

• Legal professionals and corporate compliance officers.

• Anyone interested in staying informed about the latest tax regulations and amendments.

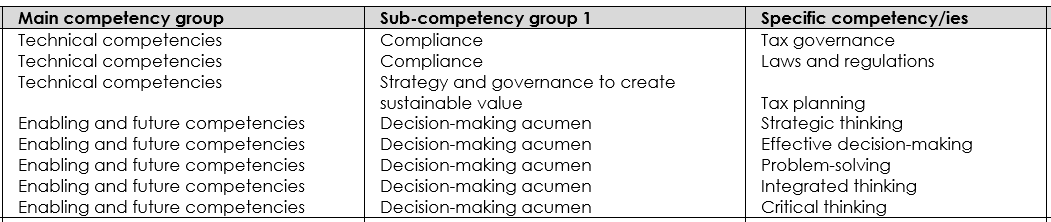

Don't miss this opportunity to gain a competitive edge in tax planning and compliance for the fiscal year 2024/5. Register now to stay informed, explore strategic considerations, and ensure your organisation is well-prepared for the changes introduced by the Tax Laws Amendments Act. Let's navigate the evolving tax landscape together! In completing this learning engagement, you will be developing the following professional competencies in the green section below.

What's included?

-

1 Live event

-

1 Quiz

-

1 Certificate